Econpile has one of the largest and most advanced arrays of piling equipment in Malaysia.

Econpile own hydraulic and mechanical rigs of various brands and models, majority of which are manufactured by German-based Bauer Group. The selection of rigs is complemented with a wide range of customised accessories such as soil augers, boring buckets and coring tools. In addition, they have vibratory hammers with various capacities to help with the driving of casings and foundation supports into the ground.

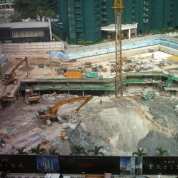

Supporting their piling operation is a wide range of general construction equipment. Their extensive fleet of crawler cranes have the lifting capacity ranging from 30 tonnes to 100 tonnes. They also own and maintain various excavators, some of which with long reach capability which are ideal for basement work.

Hydraulic Rigs

Units by Bauer with models ranging from BG7 to BG40 as well as units by G-Klemm and Liebherr capable of constructing piles up to 3200mm in diameter and up to 100m in depth

Mechanical Rigs

Units by CMV, Calweld, Soilmec, Watson capable of constructing piles ranging up to1800mm in diameter and up to 80m in depth

Diaphragm Wall

Diaphragm wall grabs ranging from 0.6m to 0.8m in width

Crawler Cranes

Units with lifting capacity ranging from 30 tonnes to 100 tonnes

CMobile Cranes

Units with lifting capacity ranging from 20 tonnes to 40 tonnes

Excavators

Units by Kobelco, Hitachi, Komatsu and Sumitomo with various capacities

Vibratory Hammers

Units by PTC with various capacities (PTC13 to PTC100)

Tools and Accessories

Wide range of custom designed soil augers, boring buckets, cleaning buckets, coring buckets, coring tools, various diameter temporary steel casings, double wall casings

Workshops

They have a full-fledged workshop sitting on a 5.3 acre lot in Bukit Beruntung, Rawang. The operation is supported by a large workforce consisting mechanics, welders, drivers & administration personnel. The facility is equipped with overhead gantry cranes and ancillary lifting equipment making the repair and fabrication of the biggest tools and parts possible. With the workshop, we have the in-house capability to undertake refurbishment, fabrication, modification repair or maintenance works on our fleet of machinery, tools & equipment. Drilling tools & parts can also be fabricated or modified at their workshop to cater to the specific needs of each individual project.

In addition, their workshop acts as the resource centre in meeting different requests from projects. It plans & coordinates the mobilisation of technical teams, equipment & materials to projects sites in response to their respective needs.

Running their own workshop grants them the flexibility to offer customised solutions or undertake various projects of different scales and difficulty levels due to their ability to modify & customise tools and equipment. With less reliance on external parties, Econpile are in a better position to manage our project deliverables and ensure a shorter project completion period

Project Highlights

Through decades of experience & accumulated engineering knowledge, Econpile stand proudly among the few foundation specialists in Msia which have the capability to undertake large-scale projects in challenging urban environments.

• Prominent Retail and Residential development at Jalan Bukit Bintang & Jalan Raja Chulan, KL

36-storey office tower at Jalan P. Ramlee, off Jalan Pinang, KL

• W Hotel and The Residences

• Electrified double tracking project between Ipoh and Padang Besar, Malaysia

•Piling works for mixed residential development at Sepang Gold Coast, Malaysia

•Earthwork, bored piles, contiguous bored piles, diaphragm wall for condominium development at Jln Menerung, Bangsar, KL

•Bored pile works using mechanical rigs for Johor River, Johor

•Contiguous Bored Pile Wall in Taman Desa Petaling

•Flood Mitigation Project in Gombak

•Secant Pile for Cofferdam at Jln Klang Lama

•Cantilever Contiguous Bored Pile in Putrajaya

Catalyst